ACH Payments: What You Need to Know About Them

Chances are, you’ve stumbled upon the term ACH payment processing at some point in running your business. Unfortunately, you might not still don’t know exactly what it means or how it works. You’re actually not alone since ACH payment is still foreign territory for a lot of entrepreneurs. Here’s everything you need to know about it:

What is an ACH payment?

An ACH payment is essentially a type of electronic bank transaction that uses the Automated Clearing House (ACH). Every time a customer makes a payment, the ACH network communicates with each other to process these payments using two computers, one to send the payment and the other to accept it.

Although the term itself is not as popularly used as credit card payments or digital wallets, ACH payments are used widely around the United States mostly for paying mortgages, loans, and other bills.

All transactions made on the ACH network should also follow the guidelines set by the National Automated Clearing House Association (NACHA).

How does ACH payment processing work?

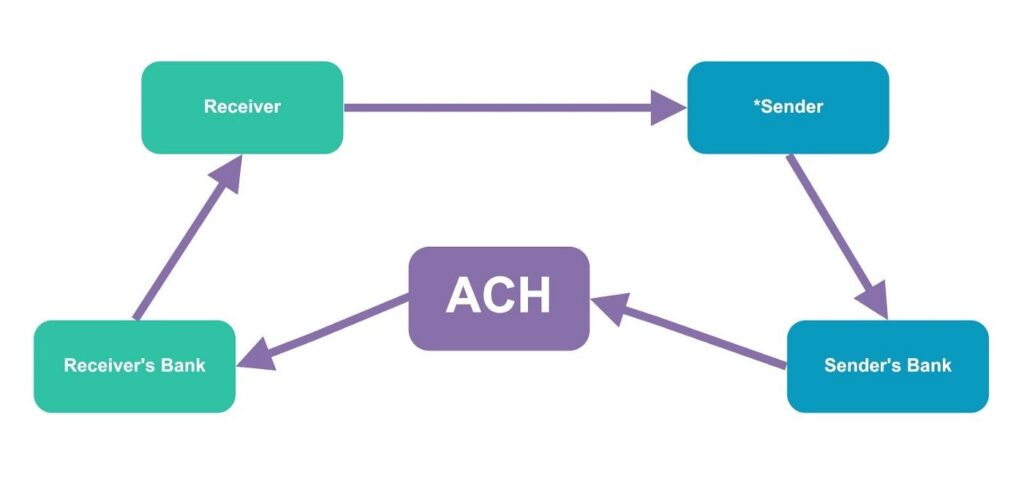

You might not be familiar with the term, but you’ve already used ACH payment before. Think about this as transferring money from your account to another account. Here, there are two individuals involved, the one who pays and the other who receives the payment. In ACH payment processing, that’s called the originator and receiver.

When a payment is processed through the ACH network, two parties are involved: the Originating Financial Depository Institution (ODFI) and the Receiving Financial Depository Institution (RDFI).

In this case, your bank or your merchant provider’s bank will be considered the ODFI while your customer’s bank will be the RDFI. An ACH Debit also happens when the client authorizes the business to process a transaction while an ACH Credit happens when that money is deposited into the receiver’s account.

To make any ACH transaction possible for both direct deposit and direct payment, the customer needs to provide bank and personal information and both the payer and payee’s account number and routing number. ACH transactions can be standard next-day ACH processing that may take 2 to 4 days to clear or same day ACH processing for immediate payment settlement.

This is stipulated by the ACH and NACHA follows four-time windows or cut-off times for same-day ACH transactions. As of March 18, 2022, NACHA also increased per-transaction limits for same-day ACH from $100,000 to $1 million.

How can you embrace ACH payments?

If you want to include ACH payments as one of your payment options for your customers, you need to find a reliable payment processor that can offer you this service. In most cases, you’ll need a merchant service provider that processes credit card payments, an accounting software provider for financial management, and a bank where your accounts are kept.

Being flexible is very important when you’re processing transactions for your business, so make sure that you learn all about ACH payments and their benefits.